Bonus tax calculator 2021

A provision expected to go. The Ohio bonus tax percent calculator will tell you what your.

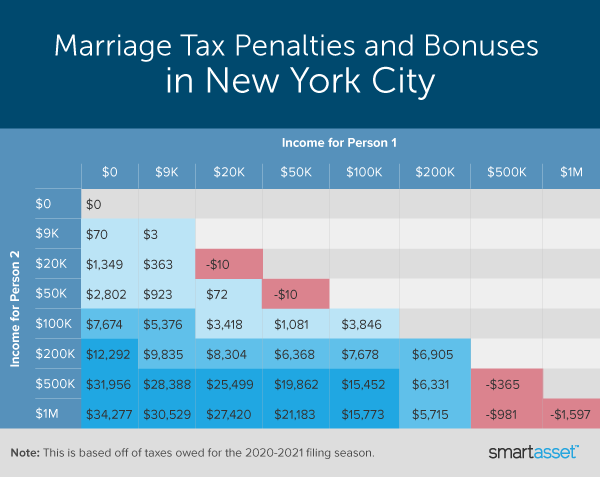

Marriage Penalty Vs Marriage Bonus How Taxes Work

All you need to do is enter your regular salary details and then enter the amount of the bonus.

. This rate was put in place after 2017. Calculate withholding on special wage payments such as bonuses. It depends as the IRS uses one of two methods.

In 2021 you will pay FICA taxes on the first 142800 you earn. If your state doesnt have a special supplemental rate see our aggregate bonus. Your employer can simply withhold the flat 22 thats applicable to all supplemental wages under 1 million.

This is known as the Social Security wage base limit. Find the federal and provincial tax that you deduct on 40577 per week. This calculator uses the Aggregate.

A tax calculator for the 2021 tax year including salary bonus travel allowance pension and annuity for different periods and age groups. The calculator assumes the bonus is a one-off amount within the tax year you. Your bonus and your regular incomewages are combined into one paycheck.

Its expected to be. The limit was 137700 in 2020. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Sage Tax Calculator Try our easy-to-use income tax calculator aligned to the latest Budget Speech announcements. Subtract the federal and provincial tax that you deduct on 400 per week. The aggregate method or the percentage method.

The result is the tax. If we now add her bonus amount R10000 to the annual income R240000 her new annual income becomes R250000. Digital Tools Sage has put together key business resources to assist.

Our Income Tax Calculator tells us that the annual tax. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay. This Ohio bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses.

Employers typically use either of two methods for calculating federal tax withholding on your bonus. This often occurs when your employer lumps your bonus and regular wages into one paycheck. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses.

We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Bonus Tax Rate In 2021 How Bonuses Are Taxed Wtop News

How Bonuses Are Taxed Calculator The Turbotax Blog

What Are Marriage Penalties And Bonuses Tax Policy Center

Flat Bonus Pay Calculator Flat Tax Rates Onpay

How Bonuses Are Taxed Calculator The Turbotax Blog

What Is The Bonus Tax Rate For 2022 Hourly Inc

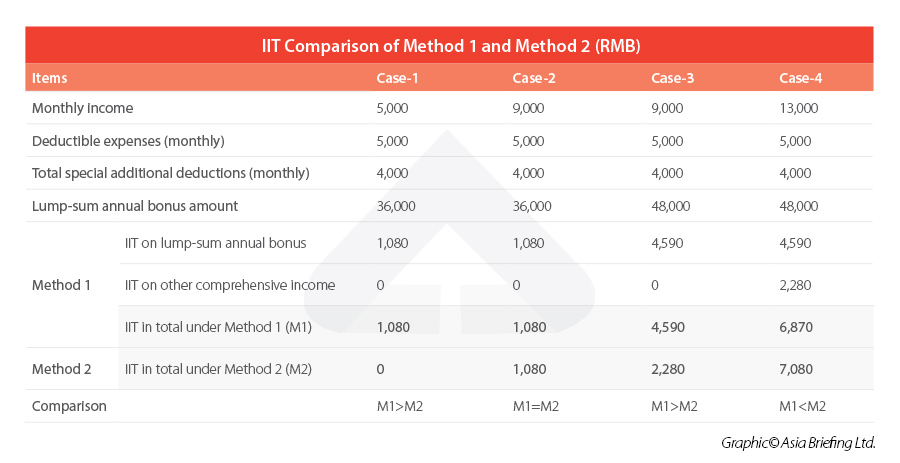

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

How To Calculate Bonuses For Employees

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

Avanti Bonus Calculator

Bonus Calculator Percentage Method Primepay

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

China Annual One Off Bonus What Is The Income Tax Policy Change

Llc Tax Calculator Definitive Small Business Tax Estimator

China Annual One Off Bonus What Is The Income Tax Policy Change